To understand the importance of Financial Planning and Benefits of Long Term Investing please scroll down  further.

further.

Our Services

The wealthiest retail clients of investment firms demanded a greater level of service

Financial Goals

With the expert advice like you are into taking advice in legal issue advocate advice in case of taxation advice CA ,we are hire to provide a financial planning predefine & timely renew.

A Goal Without a plan is just a wish

For saving and investment there should be a Strategy for

Financial Plan

We can help guide you on how to achieve your goals. Many are too busy to research all the options available. Let us make your life easier by inviting you to have a full financial planning review. We aim to provide you with bespoke financial solutions that suit your needs. Our goal is to meet your financial needs and aim to maximise your wealth.

Achieve your goals in 5 simple steps

Step 1

Establish the goal/relationship

The purpose of establishing the relationship to begin the financial journey with the clarification of a financial destination.

Step 2

Gather the Relevant Data

The financial planner asks about the client's financial situation. The planner gathers all necessary documents at this stage before giving advice.

Step 3

Analyze the Data

The financial planner analyzes client information to assess his or her current situation and determine what must be done to achieve the client's goals.

Step 4

Develop a plan

The financial planner offers financial planning recommendations that address the client's goals, The planner listens to client concerns and revises recommendations as appropriate.

Step 5

Implement the plan

The financial planner and client agree on how recommendations will be carried out. The planner may carry out the recommendations for the client or serve as a "coach, " coordinating the process with the client and other professionals such as attorneys or stockbrokers.

TAKE THE FIRST STEP - START INVESTING

Lorem Ipsum is simply dummy text of the.

Lorem Ipsum is simply dummy text of the.

Lorem Ipsum is simply dummy text of the. when an unknown printer took a galley.

BAS ITNA HI CHAHIYE

FAMILY WITHOUT FINANCIAL GOALS INVESTMENT

FAMILY WITH FINANCIAL GOALS INVESTMENT

SIP, its like a good EMI

Just like you choose an EMI for today's big expenses, choose an sip to fulfil tomorrow's dreams.

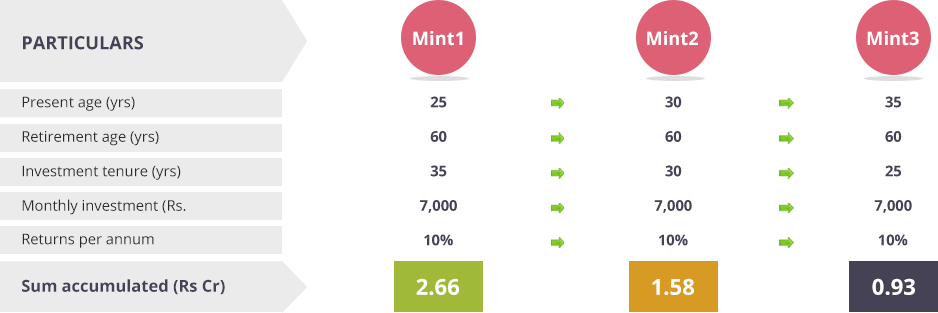

As You Start Early As You Get Wealthy Early

Magic of Compounding

“Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

An Early Bird gets a Bigger Pie

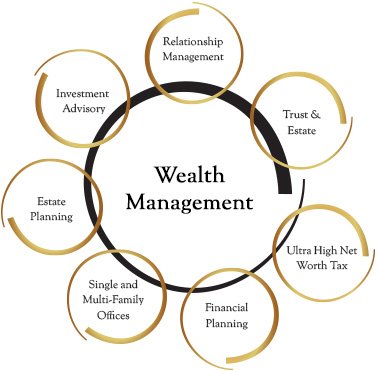

Advantages of Wealth Management

Wealth management is an important practice for every business and individual. Managing financial investment, income, tax and other sources of cash helps you monitor the money that you have. Some businesses are investing on wealth management services to help them oversee their financial activities and set an effective plan on how to manage cash flow. It is necessary to protect your wealth and know the current status of your finances. When you are aware of how your money is performing, it’s easier to make decisions involving cash.

Effective Benefits of Wealth Management

1). Comprehensive financial advice.

Wealth management offers a comprehensive analysis of your financial health. It will provide you details of the current status of your money. When you know where you stand, it is easier to get advice and make decisions for investments and financial plans.

2). Provides gap analysis.

The assessment between your goals and current financial status is necessary to help you identify and plan your actions carefully. When you conduct gap analysis, it lets you evaluate your resources and allows you to see the strength and weakness of your plan.

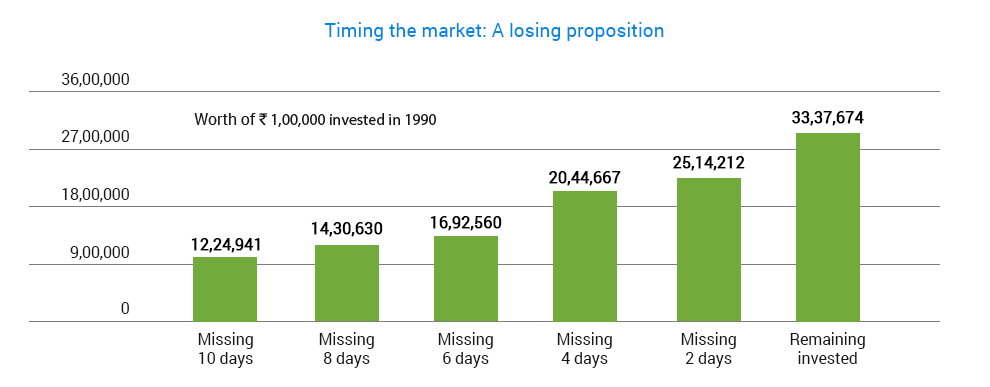

Time in Market Vs Timing

Also, often the risk of not being in the market is higher than the risk of being in it.

Fund Performance

SENSEX

MARKET WATCH

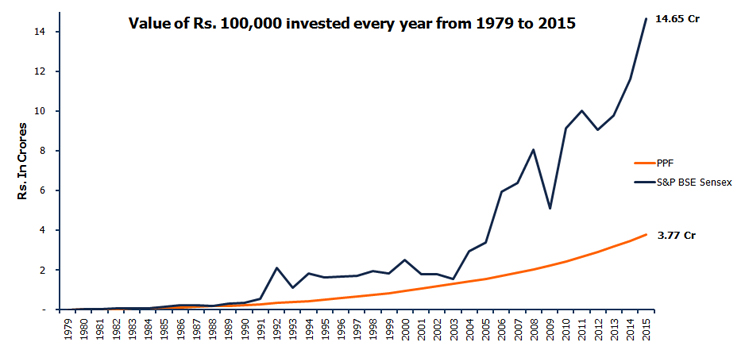

Comparison PPF vs S&P BSE Sensex

Equities have delivered far superior returns than PPF

Equities have delivered far superior returns than PPF

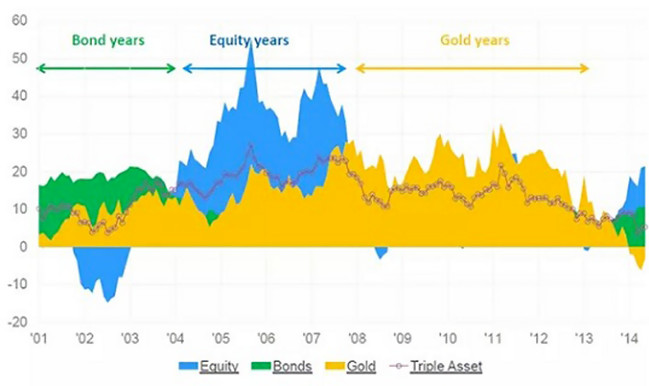

Importance of Asset Allocation

Financial Video

Financial Video

WHY SLM ?

Honest and Transparent Advice

We keep our clients informed about financial plan

Planning your goals basis your personal profile

Understanding your risk appetite

Goal-based Asset allocation in Mutual funds